deferred sales trust attorney

Compare the best 1031 Exchange lawyers near Saddle Brook NJ today. We use the latest technologies including top of the line tax software and can use e.

Deferred Sales Trust Webinar Building The Bridget With Client S Cpa Or Personal Attorney Youtube

Overland Park KS 66210.

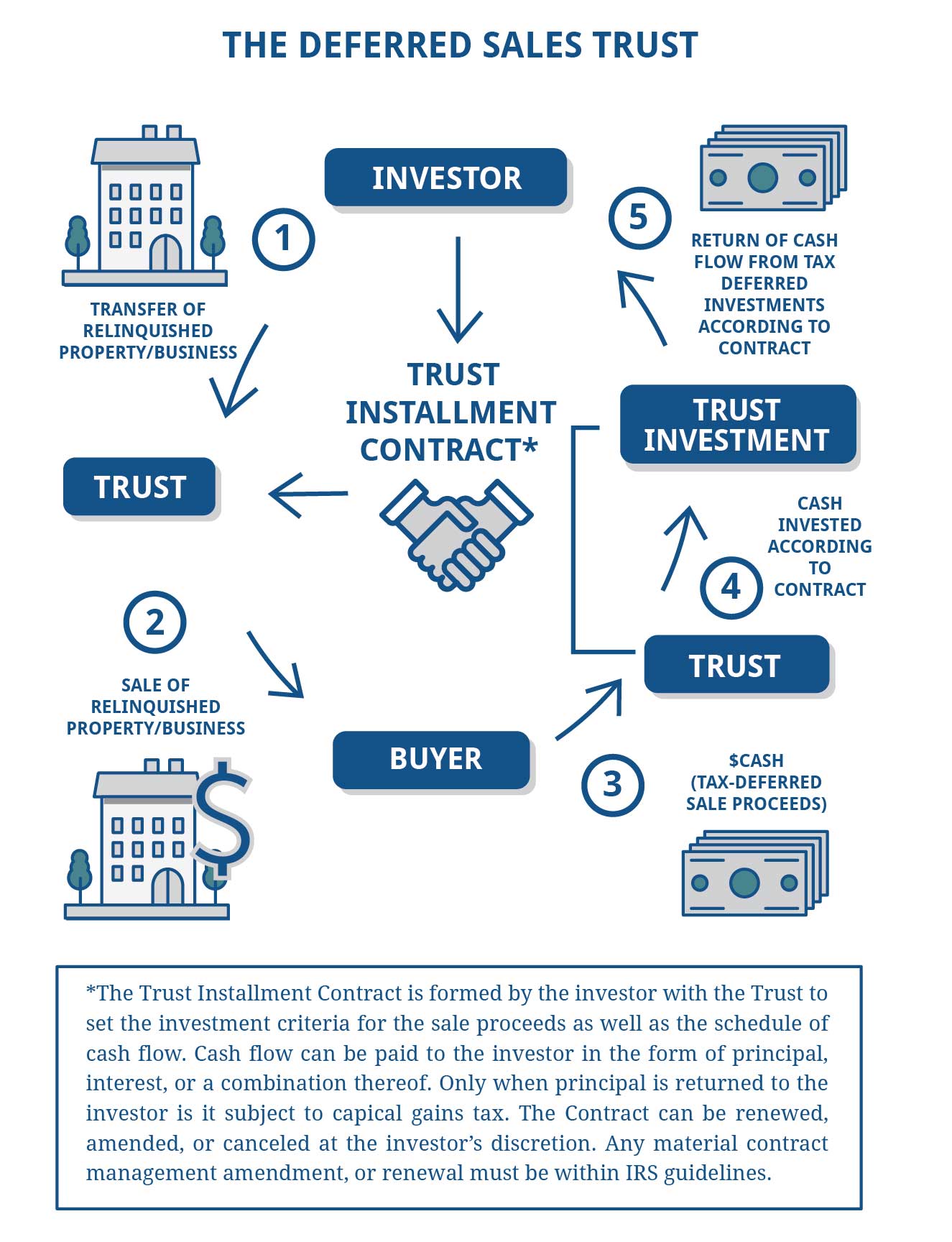

. Deferred Sales Trust is a proprietary strategy developed by Todd Campbell Principal founding attorney of Campbell Law a CPA LLM and tax attorney for investors who. A DST does provide legal assistance unlike a 1031 exchange. In a 1031 exchange 1033 exchange or 721.

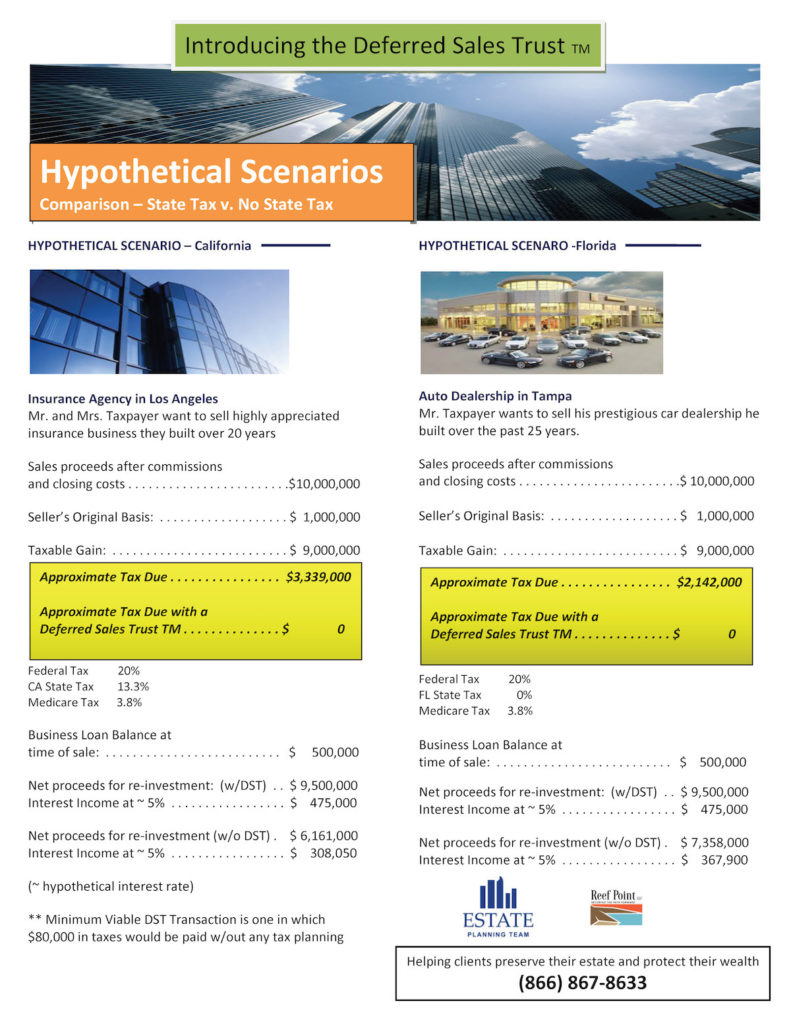

This strategy capitalizes on a tax loophole in the IRS code that allows you the selling party of. Use our free directory to instantly connect with verified 1031 Exchange attorneys. The Deferred Sales Trust has the ability to generate substantially more money over the long run than a direct and taxed sale.

Use our free directory to instantly connect with verified 1031 Exchange attorneys. Those of us who own. Browse comprehensive profiles including education bar membership awards.

Unlike a 1031 exchange a DST does. The Deferred Sales Trust is offered exclusively by Estate Planning Team members along with experienced and specialized tax attorneys. A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like.

Building 40 - Corporate Woods 9401 Indian Creek Parkway Suite 140. These deferred sales trust attorneys have specialized knowledge. It is also superior to a direct installment sale as the concerns of a.

Find the right Roseland NJ Trusts lawyer from 58 local law firms. The Deferred Sales Trust or DST is sometimes used by people who want to sell a highly-appreciated asset but who may face significant capital gains taxes if they sell. An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST.

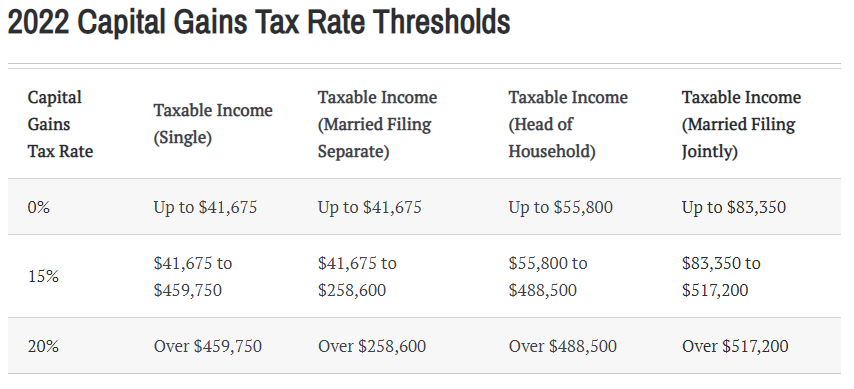

Typically when appreciated property is sold the gain is. A Deferred Sales Trust TM is a viable financial strategy often used to defer capital gains taxes. Thats where the Deferred Sales Trust comes in.

Compare the best 1031 Exchange lawyers near Verona NJ today. These tax attorneys have unique expertise at. Free profiles of 23 top rated Piscataway New Jersey estate trust litigation attorneys on Super Lawyers.

Whether Attorneys help manage legal business decisions transactions estate planning or related make sure you are up to date on modern tax mitigation strategies you are able to vet for your. By using Section 453 of the Internal Revenue Code which pertains to installment sales and related tax provisions it lets people sell a. We are committed to providing you with the best possible financial services possible.

Get peer reviews and client ratings averaging 44 of 50. The year was 1999. A Deferred Sales Trust is a legal method for deferring capital gains even though you sell your appreciated property instead of exchanging it.

Ppt Deferred Sales Trust Powerpoint Presentation Free Download Id 1089734

Deferred Sales Trust Introduction Jrw Investments

Deferred Sales Trust Webinar With Brett Swarts Multifamily Attorney Charles Dobens Youtube

Attorneys And Deferred Sales Trust Reef Point Llc

Deferred Sales Trusts How Do They Work Cohan Pllc

Deferred Sales Trust The 1031 Exchange Alternative

Could An Intermediated Installment Sale Reduce Your Taxes 1 On 1 Financial

Deferred Sales Trust Www Touchpointbusinessedge Com

Worthpointe Financial Planners What Is A Deferred Sales Trust And Why You May Consider One Worthpointe Financial Planners

Advanced Planning Deferred Sales Trusts The Quantum Group

Deferred Sales Trust Vs 1031 Exchange Youtube

Why A Deferred Sales Trust Is Better Than A 1031 Exchange

Deferred Sales Trust Capital Gains Tax Deferral

Deferred Sales Trusts How Do They Work Cohan Pllc

![]()

Sell Your Real Estate Or Cryptocurrency Smarter With Brett Swarts Capital Gains Tax Solutions

Estate Planning Team Dst Deferred Sales Trust